ORGANIZE YOUR MONEY

I can't believe it's already the end of March. This means two things:

I can't believe it's already the end of March. This means two things:

- My husband's birthday is near (it's actually today - wish him a happy birthday here)

- And taxes are due

I dropped the ball this year and did the minimum amount of financial work for my business. Meaning taxes this year will likely take triple the time it would usually. Not to mention how unhealthy and stifling it is for my business to not keep track of where and when money is coming and going. Do not do what I did. Instead, follow these tips to stay organized and ready for tax season.

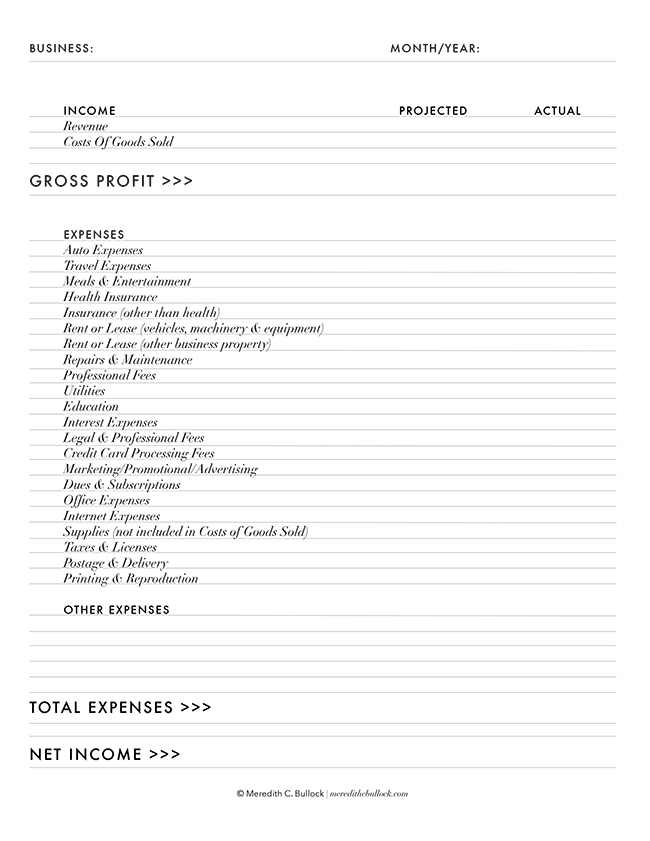

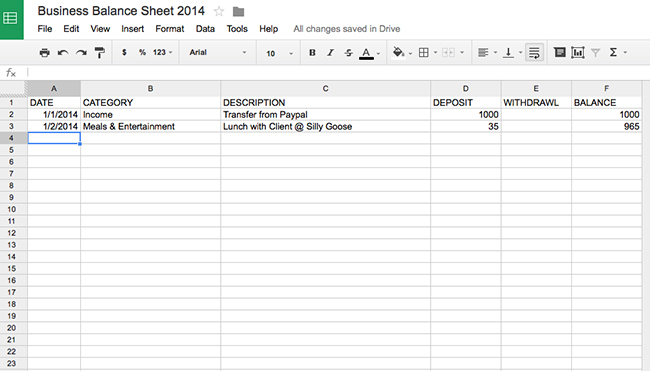

Keep a balance sheet A balance sheet is essentially a spreadsheet or a piece of paper with lines and categories for you to organize when money is coming in and out. You can easily create one in google docs (see screen shot below), with windows excel, write on a piece of paper, or download this pdf I created here and pictured below. The one I use (and created for you below) has a column for projected and actual income and expenses, that way you can plan ahead and budget your money. You can use this pdf each month and at the end of the year to tally everything up.

Put money aside Save yourself the stress mentally and financially and put away 10-15% of your monthly income into your savings for taxes. Odds are you'll have more than enough money saved to not only pay the man, but to also to go on a mini vaca or maybe attend that workshop you've had your eye on.

Have a separate business account Don't try to decipher business money with home money all in one joint account - that's terribly stressful. Do yourself a favor and open up a separate checking and savings account just for your business. That way when you meet with a client over lunch or run to Office Max to grab some ink and paper, you can whip out your business account card and swipe away knowing it won't get lost with your grocery and home charges.

Stay organized Using services like Mint, Freshbooks, Outright or Quickbooks can help you stay organized throughout the year and some offer functions and features that help prepare you for tax season. Personally I use Mint and love it. I can budget, receive texts when I'm close to going over budget, check balances from the app on my phone, create goals and its all free. Another tip to staying organized is stowing away your receipts each month in an accordion folder. That way when you need to find a receipt for a specific month, you don't have to dig through the entire years worth. Trust me, it's not pretty when you have to do this.

Print off monthly bank statements If you're like me, you use your computer for mostly everything when it comes to money. So when you receive your monthly statement from PayPal or your bank, print it out. Otherwise you might have to go backward for months in order to track down each expense. It's also a good idea to have a paper trail of everything just in case.

Hire an accountant Back when I was an employee and received a paycheck it was easy to use a service like Turbotax online. But now I'm self-employed and have a billion expenses and write off's to keep track of, I've hired an accountant. Actually I acquired my accountant through my husband when we got married and it was the best thing that ever happened to my money. My accountant keeps me organized, sends me a tax preparation packet in February and answers any questions whenever I have them - like when I discovered I had to charge sales tax (oops). When you're staring out, it might make sense to do them yourself, but as soon as you can afford an accountant, do it. He will save you time, he will cost a chunk of change but he always makes sure everything is legit.

Need more financial advice? Check out these articles:

What I Learned at Tax Time From My First Year as an Indie Business Owner 10 Tax Deductions for Small Biz Owners Being Prepared for Tax Time Taxes Made Easy Advice: How do you Deal with Tax Deductions and Working with an Accountant Taxes 101 for Etsy Sellers 5 Ways to Make Tax Season More Serene

How about you, did you file yet? Do you have any tips, resources or advice to share for us creatives scrambling to file taxes in time?